Dying Without a Will in Montana

Married, Living Children from Previous Marriage Only, Spouse has not adopted child

from your previous marriage, Spouse does not have Living Children from Previous Marriage.

Situation #9 Example 1

Assets Value: $400,000

Example 1

All children from previous marriage are living.

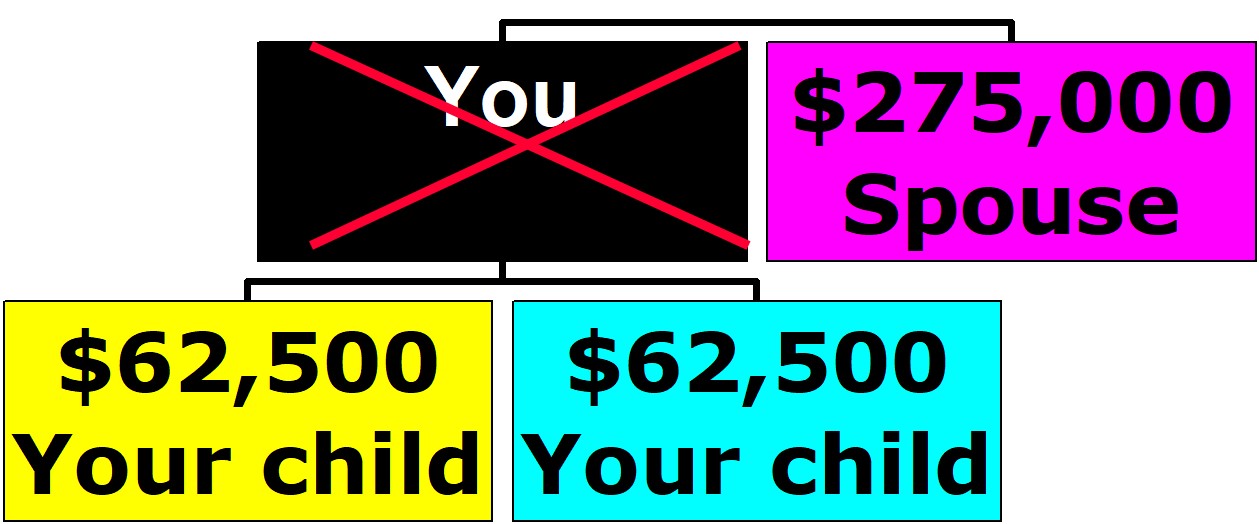

Assume you pass away without a written will. You have assets valued at $400,000.

Your spouse receives a total of $275,000. Your spouse receives the first $150,000 plus 1/2 of the remaining balance. [$400,000 - $150,000 = $250,000; $150,000 + $125,000 (1/2 the remaining balance of $250,000) = $275,000].

Your two children from your previous marriage split the remaining balance of $125,000. Each receives $62,500. ($400,000 - $275,000 = $125,000 ÷ 2 = $62,500).

Your spouse may also have a right to the elective share,the homestead allowance, exempt property, and the family allowance which is protected from creditors.

If this is not the division you desire, then you need to write a will.

Montana State University Extension has additional information about estate planning. You may download and print out all MontGuides free at this site: www.montana.edu/estateplanning/eppublications.html

To explore another family situation, follow this link...