Dying Without a Will

Married, Living Children from Previous Marriage Only, Spouse has NOT adopted child from your previous marriage, Spouse has Living Children from Previous Marriage that you have adopted,Situation #11 Example 1

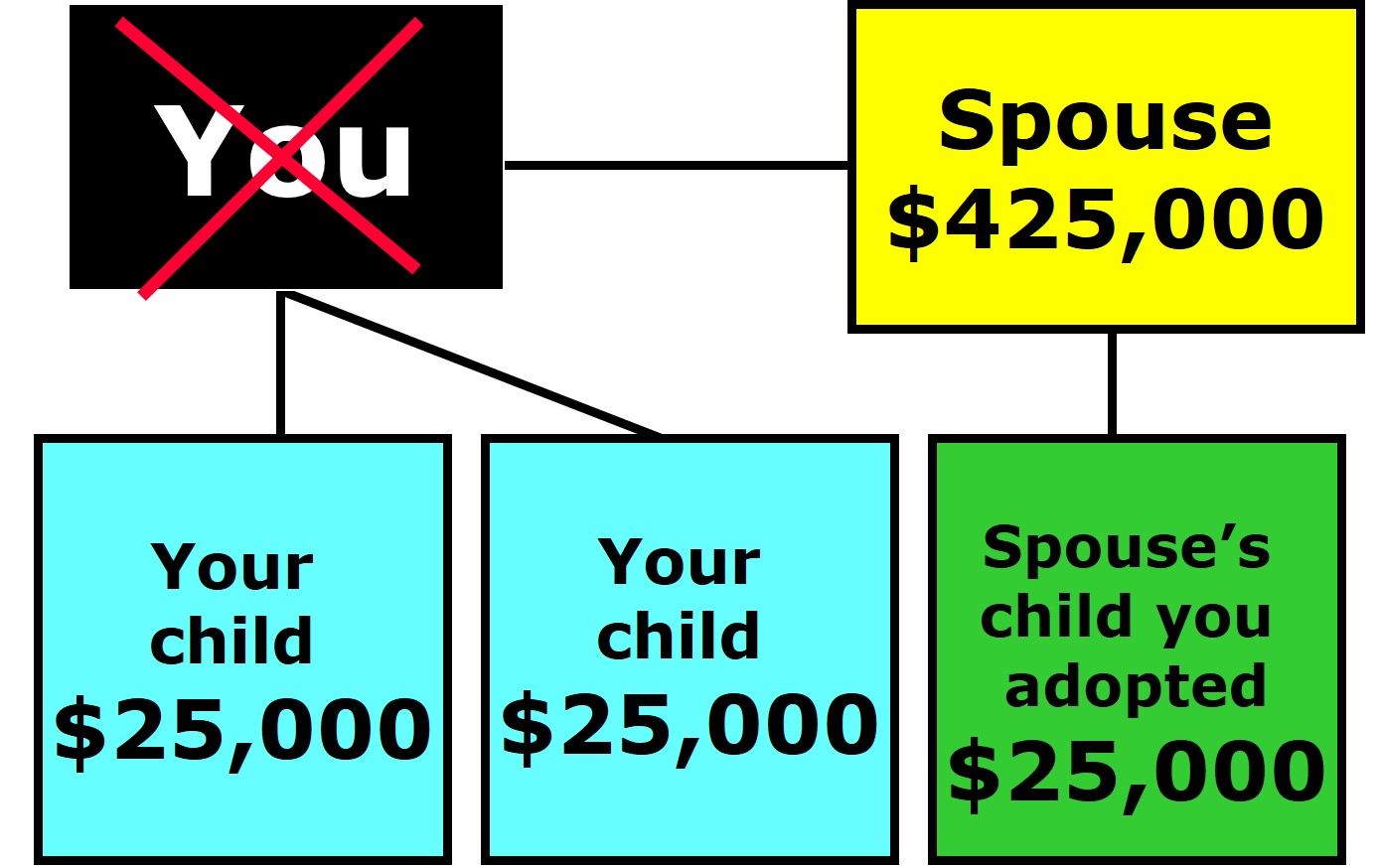

Asset: $500,000

Example 1

All children from previous marriage are living and your spouse's child whom you adopted.

Assume you pass away without a written will. You have assets valued at $500,000.

Your spouse receives a total of $425,000. Your spouse receives the first $150,000 plus 1/2 of the remaining balance. [$500,000 - $150,000 = $350,000; $150,000 + $75,000 (1/2 the remaining balance of $150,000) = $425,000].

Your children are the two from your previous marriage and the one you adopted from your spouse's previous marriage. They split the remaining balance of $150,000 ($500,000 - $425,000 = $150,000 ÷ 3 = $25,000) by right of representation.

Your spouse may also have a right to the elective share,the homestead allowance, exempt property, and the family allowance which is protected from creditors.

If this is not the division you desire, then you need to write a will.

Montana State University Extension has additional information about estate planning. You may download and print out all MontGuides free at this site: www.montana.edu/estateplanning/eppublications.html

To explore another family situation, follow this link...