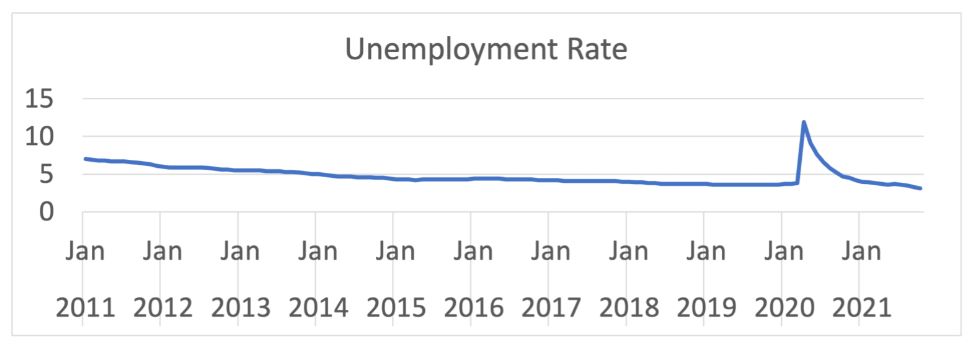

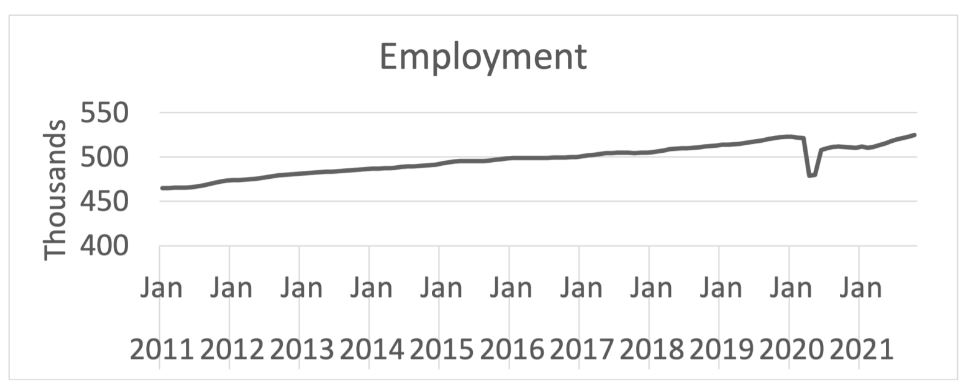

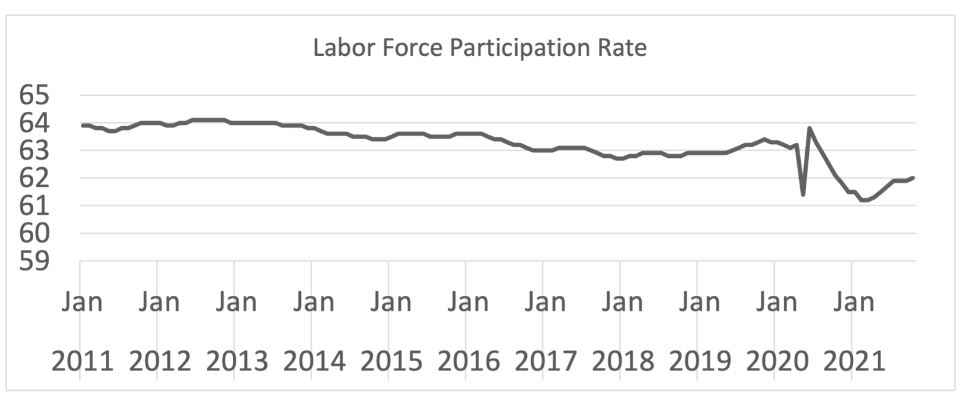

Help wanted signs are visible on nearly every street corner and store hours have been reduced. Employers and consumers are likely wondering why labor appears so scarce and whether these changes are the results of transient economic trends or more fundamental structural changes in the labor supply. The unemployment rate in Montana is lower than the national average (2.8% compared to 3.9% nationally). While the national unemployment rate is relatively low, it still exceeds the pre-pandemic 3.5% of February 2020. We must also keep in mind that workers who dropped out of the workforce entirely and are not actively looking for a new job are not included among the unemployed. Nevertheless, total employment in Montana is higher than it has ever been (525,073 in October 2021). However, the size of the labor force has also be rising, and the labor force participation rate is still below pre-pandemic rates (62% compared to 63.2% in February 2020).

Figure 1. The Montana Unemployment Rate is Down

Data Source: Bureau of Labor Statistics

Figure 2. Montana Employment Has Risen Steadily

Data Source: Bureau of Labor Statistics

Figure 3: The Montana Labor Force Participation Rate Is Still Low

Data Source: Bureau of Labor Statistics

Nationally, workers voluntarily quit their jobs at record rates in 2021. Twenty million

U.S. workers quit their jobs between May and September 2021. Three percent of workers

quit their jobs in November 2021. (For comparison, the quit rate was only 2.3% in

November 2019, before the pandemic.) Record high quit rates are a major contrast from

previous recessionary periods characterized by economic uncertainty. Typically, workers

remain in their jobs when there is economic uncertainty. For example, the quit rate

in November 2009, when the country was still in the Great Recession, was 1.4%.

Why is the labor force participation rate still so low and quit rates high? The answers

are likely complex and there is not yet sufficient data to make confident conclusions.

However, we might surmise a few factors that likely have some influence in current

labor market trends.

First, some workers left the workforce over safety concerns during the pandemic. Government

transfer payments might have made it easier for workers to remain out of the workforce

for some time, and extended unemployment benefits permitted some workers who were

laid off during the pandemic to be more selective about taking another job. However,

most government benefits that were increased during the pandemic have expired. Older

members of the workforce might have decided to retire early, but early retirees certainly

do not account for the total increase in quit rates and low labor force participation.

It appears that many workers are reassessing what jobs they want to hold in the future,

and some might have dropped out of the workforce completely.

Challenges finding childcare might deter many parents from reentering the workforce.

Some dual income homes transitioned to single-income and might remain so. Given the

disruption to childcare services in 2020, the high cost of childcare, and the frequent

necessity of keeping children at home when children have the sniffles, some families

might decide to keep one parent at home permanently. To attract more workers, some

firms might have to consider more creative approaches to providing childcare or permit

workers to work from home—when possible.

Supply chain disruptions are also likely playing a role in the labor market. For example,

delays at Los Angeles and Long Beach ports put strain on truck drivers, who are typically

paid by the mile rather than the hour. When shipments were delayed, some truck drivers

reportedly said that it was not worth their time to wait at the ports for shipments

to get unloaded before they could load them to their trucks (Rural Migration News).

Border policies could exacerbate labor and supply chain challenges. Canada and the

United State recently announced that they would require truckers crossing the border

to be vaccinated for Covid-19. Two-way trade between Canada and the United States

was valued over $600 billion in 2019, and 80% of that trade was transported on trucks

(Vieira and Smith, 2022). Although most workers have already been vaccinated, Canadian

Trucking Alliance estimates that at least 10% of truckers in Canada are not vaccinated,

and U.S. shares are not known.

As the impacts of the pandemic recede, labor force participation will likely increase,

but perhaps not to pre-pandemic levels. Although it is too early to quantify a structural

change, there have been some major long-term shifts in the labor force. In response,

firms will continue to automate more routine tasks, from tasks in meat packing disassembly

lines to ordering your meals at restaurants. The future of the U.S. workforce will

be different, and employers and consumers will have to adjust to change.

Cited Sources:

Paul Vieira and Jennifer Smith (January 13, 2022) “Truckers Fret Over Pending Covid-19

Vaccine Rules at U.S.-Canada Border” The Wall Street Journal

“Labor Trucking Covid” Rural Migration News 28(1) January 2022. https://migration.ucdavis.edu/rmn/more.php?id=2680

See other Related Articles:

Job Vacancies and the Role of Immigrants

Is H-2A Reform Possible? And What Would It Mean for Workers and Employers?

Help Wanted & H-2A

Has Montana's Labor Force Shrunk?

Diane Charlton

Associate Professor