Tax Policies and Shifting Tax Burden Between Property Classes Across Montana Part 4 (Series on Property Taxation in Montana)

October 30, 2024

By Greg Gilpin

In Part 4 of this series, I provide an overview of how the tax burden is defined and measured, followed by an analysis of how the tax burden between property classes has shifted in Montana since 1992.

The property tax burden refers to the total amount of taxes paid relative to a property's market value. A shift in tax burden occurs when the responsibility for paying taxes moves from one group of taxpayers to another. This shift can happen both within and between property classes. If property taxes increase proportionally across properties, the tax burden remains unchanged.

Overview of Changes in Market Value, Taxes Paid, and Tax Burden in Montana

The biggest challenge for property taxation is that markets don’t adjust uniformly

– some sections of the economy grow rapidly while others stagnate or even decline.

Over the past thirty years, Montana has experienced significant sectoral shifts, reflected

in changing property values across various property classes. The impact of these dynamic

economic changes can be analyzed by examining changes in the share of total market value and the share of total taxes paid. By comparing these two measures over time, we gain an understanding of how the tax

burden has shifted between property classes. In this section, I use data from the

Department of Revenue’s Property Tax Information Handout, provided to the Governor’s Property Tax Task Force.

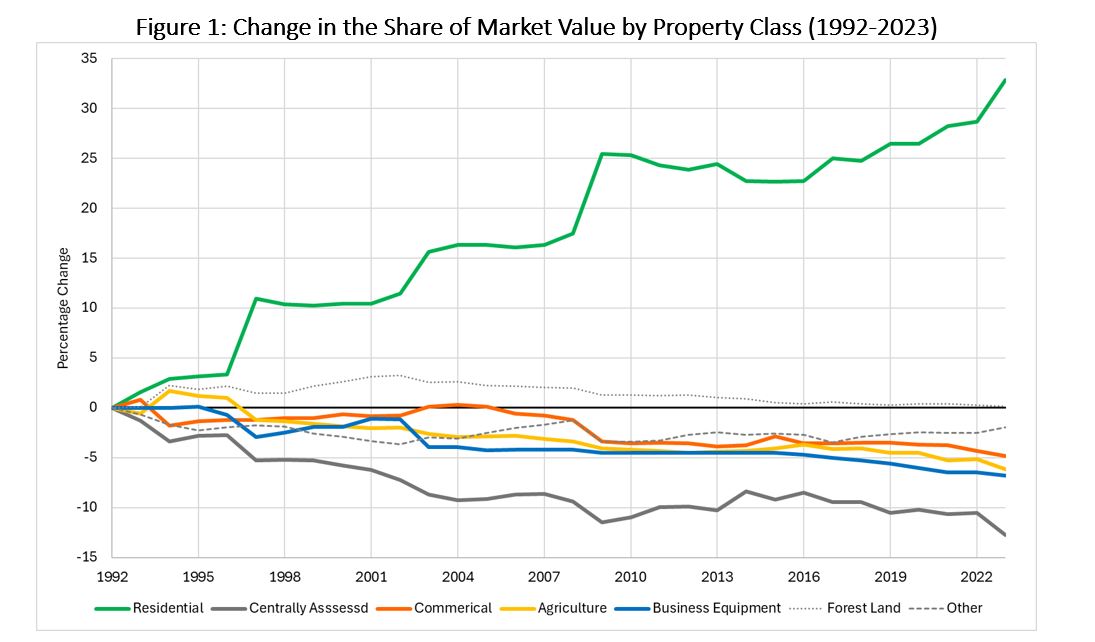

Change in the Share of Market Value

Figure 1 illustrates the annual changes in the share of market value between different property classes from 1992 to the present. The data show a sharp

increase in the share of residential property values, alongside significant declines

in the shares of centrally assessed, commercial, and agricultural property values.

Note: Annual changes sum to zero. Source: Author’s calculations using DOR Handout and plot digitizer software.

Changes in the Share of Market Value (1992-2023):

| Residential | +32.9 pp |

| Centrally Assessed | -12.7 pp |

| Commercial | -4.8 pp |

| Agricultural | -6.1 pp |

| Business Equipment | -6.8 pp |

| Forest Land | +0.1 pp |

| Other | -2.6 pp |

(Note: pp refers to percentage points. The changes in the share of market value sum to zero.)

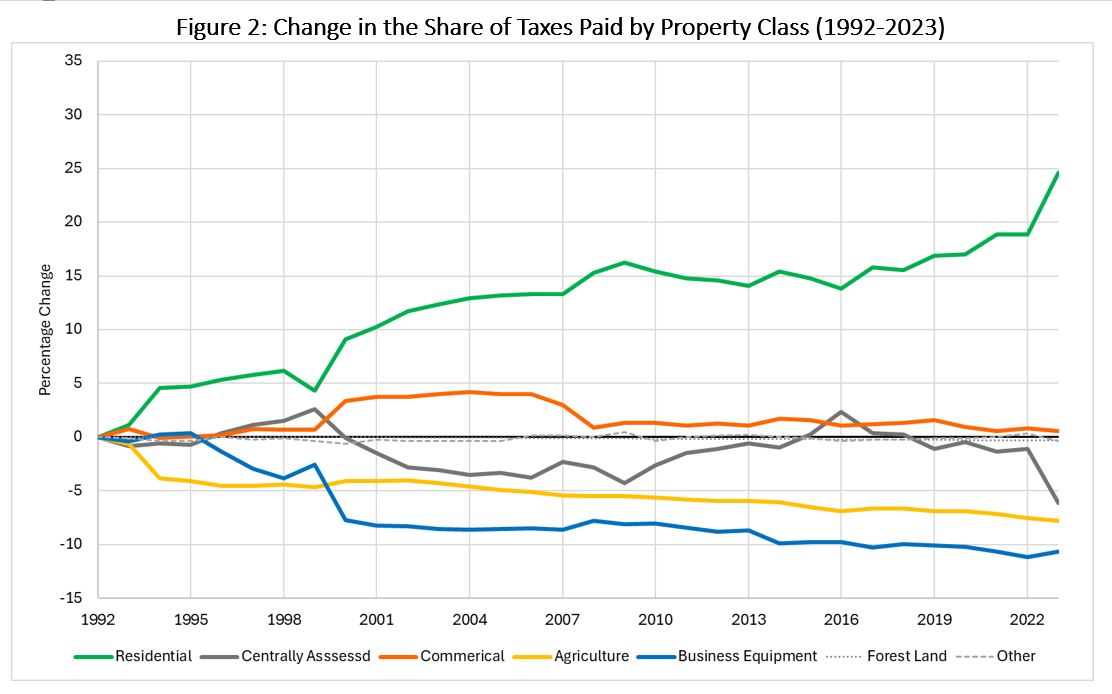

Share of Taxes Paid

Figure 2 shows the annual changes in the share of taxes paid across different property classes

from 1992 to the present. The data reveals a substantial increase in the share of

taxes paid by residential properties, a slight rise for commercial properties, and

declines in the shares paid by centrally assessed, agricultural, and business equipment

properties.

Note: Annual changes sum to zero. Source: Author’s calculations using DOR Handout and plot digitizer software.

Changes in the Share of Taxes Paid (1992-2023):

| Residential | +24.6 pp |

| Centrally Assessed | -6.1 pp |

| Commercial | +0.6 pp |

| Agricultural | 7.8 pp |

| Business Equipment | -10.7 pp |

| Forest Land | -0.3 pp |

| Other | -0.4 pp |

(Note: pp refers to percentage points. The changes in the share of taxes paid sum to zero.)

Tax Burden Between Property Classes

Tax burden refers to the amount of taxes paid relative to a property's market value.

In this analysis, tax burden is calculated as the change in the share of taxes paid minus the change in the share of market value:

- Increasing tax burden: A positive value indicates the property class is proportionally paying more in taxes to its market value over time.

- Decreasing tax burden: A negative value indicates the property class is proportionally paying less in taxes to its market value over time.

- No change in burden: A zero value indicates the property class consistently pays taxes in proportion to its market value over time.

Table 1 shows the shifts in tax burden across property classes between 1992 and 2023.

The data reveals a decrease in the property tax burden for residential, business equipment,

agricultural, and forest land properties, while centrally assessed, commercial, and

other properties experienced an increase.

Table 1: Shifts in Tax Burden between 1992 and 2023

| Change in the Share of Taxes Paid |

- | Change in the Share of Property Values |

= | Shift in Tax Burden |

|

| Residential | +24.6 pp | +32.9 pp | -8.3 pp | ||

| Centrally Accessed | -6.1 pp | -12.7 pp | +6.6 pp | ||

| Commercial | +0.6 pp | -4.8 pp | +5.4 pp | ||

| Agricultural | -7.8 pp | -6.1 pp | -1.6 pp | ||

| Business Equipment | -10.7 pp | =6.8 pp | - 3.9 pp | ||

| Forest Land | -0.3 pp | +0.1 pp | -0.4 pp | ||

| Other | -0.4 pp | -2.6 pp | +2.2 pp | ||

| Total | 0.0 pp | 0.0 pp | 0.0 pp |

Notes: pp refers to percentage points. Source: Author’s calculations using DOR Handout and plot digitizer software.

Key Insights on the Tax Burden between 1992 to 2023

- Residential properties experienced the most significant decrease in tax burden.

- Centrally Assessed properties experienced the most significant increase in tax burden.

- Commercial properties experienced an increase in tax burden.

- Agricultural properties experienced the second-largest decrease in tax burden.

- Business Equipment experienced the third most significant decrease in tax burden.

Despite these shifts, the changes in tax burden are small relative to the sustained

increase in taxes paid by all property classes.

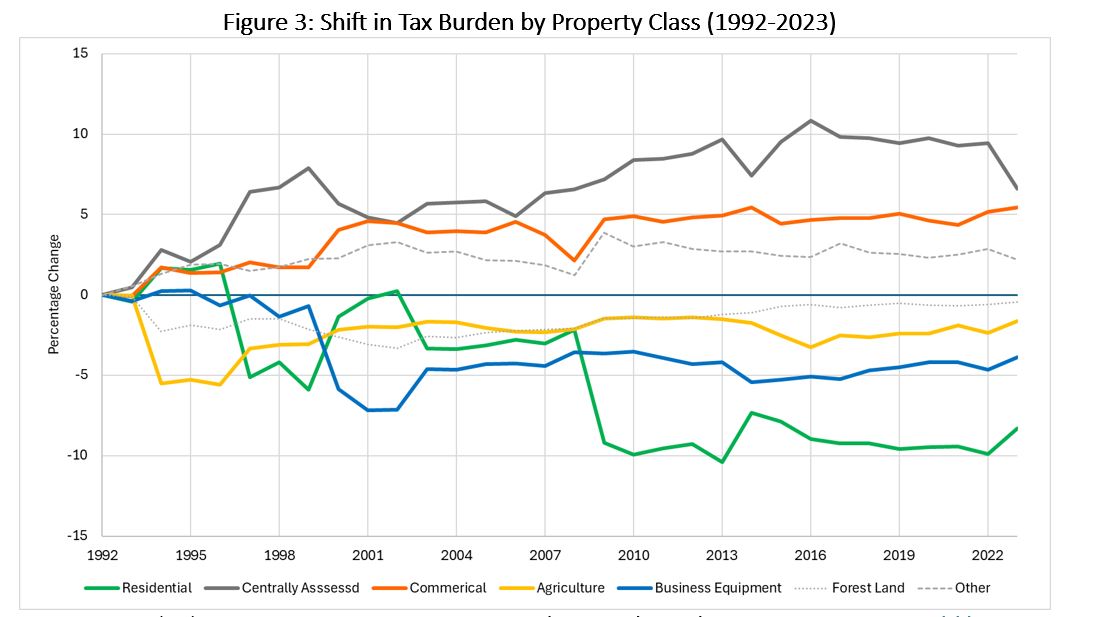

Annual Shifts in Tax Burden

The analysis can be extended to explore how the tax burden has shifted annually between

property classes. This helps identify when significant changes occurred. Figure 3

shows the annual shifts in tax burden from 1992 to 2023.

Note: Annual shifts in tax burden sum to zero. Source: Author’s calculations using DOR Handout and plot digitizer software.

Key Insights on Shifts in Tax Burden Between 1992 and 2023

- 1990s: Significant shifts occurred in the mid-to-late 1990s, with increases in the burden for centrally assessed properties and decreases for agricultural, business equipment, and residential properties.

- 2000s: There was little change in tax burden until 2009, when the residential property tax burden decreased substantially.

- 2010s: Tax burden remained elevated but stable across most property classes.

- 2023: Centrally assessed property tax burden decreased, while residential, agricultural, and business equipment experienced increases.

Substantial changes in tax burden suggest that tax policy has not maintained value-neutral

taxable rates over time.

Even with significant property tax reductions for major industrial properties in 2023, the tax burden on this sector remained elevated compared to 1992 levels.

Challenges in Analyzing Tax Burden

There are three main challenges when measuring the tax burden:

1. Choice of base year.

The base year used in tax burden shift analysis significantly affects the magnitude

of the observed shift. In the above case, 1992 is the base year, but a different base

year, such as 2003, results in a more minor shift in the residential tax burden. For

example, the residential tax burden shift is -5.0 pp when 2003 is the base year, compared to

-8.3 pp with 1992 as the base year. This is because the substantial shifts in tax burden during 1999 and 2000 are excluded

when using a narrower timeframe.

Table 2: Shift in Tax Burden Between 2003 and 2023

| Change in the Share of Taxes Paid |

- | Change in the Share of Property Values |

= | Tax Burden |

|

| Residential | +12.3 pp | +17.2 pp | -5.0 pp | ||

| Centrally Accessed | - 3.1 pp | - 4.0 pp | +1.0 pp | ||

| Commercial | - 3.4 pp | - 4.9 pp | + 1.5 pp | ||

| Agricultural | -3.5 pp | -3.5 pp | 0.0 pp | ||

| Business Equipment | -2.1 pp | -2.8 pp | +0.7 pp | ||

| Forest Land | -0.3 pp | -2.4 pp | +2.1 pp | ||

| Other | 0.0 pp | 0.4 pp | -0.4 pp | ||

| Total | 0.0 pp | 0.0 pp | 0.0 |

Notes: pp refers to percentage points. : Author’s calculations using DOR Handout and plot digitizer software.

2. Accuracy of taxes paid.

Tax burden shift analysis depends on the accuracy of taxes paid data. Inaccuracies

can lead to over- or underestimation of the actual tax burden shift. For example,

Dennis Taylor, a longtime city manager in Montana, noted that the share of taxes paid by residential properties in 2023 was 59%, not 57.6%

as initially reported. Using 2003 as the base year, this adjustment would reduce the shift in the residential tax burden to -3.6 pp instead

of -5.0 pp.

3. Accuracy of property values.

The accuracy of property values within each class is crucial for tax burden analysis. The analysis may become inaccurate if property values are reduced due to exemptions or other tax policies. For instance, NorthWestern Energy successfully sued the Department of Revenue in 2023, reducing its assessed market value from $2.9 billion to $2.7 billion. These adjustments could mean the residential tax burden did not decrease as much as expected and may have even increased. It is important to note that this analysis does not rely on taxable values, which are influenced by tax policies, but on property values.

How Are Tax Burdens Decided?

Tax burdens are determined by a combination of assessed market values, property tax

exemptions, class codes, and the taxable rate schedule. The Montana State Legislature

sets the taxable rate for each class of property. This body is responsible for all

tax policies related to property assessment and converting market values into taxable

values.

Historically, Montana adjusted the tax burden by adjusting property tax rates—through a process known as rate mitigation—until 2015. Since then, while property

rates have remained unchanged, there has been an expansion in property exemptions

and class codes. Notably, the limited shift in tax burdens since 2015 suggests no need for adjustments

between property classes.

Should Tax Burdens Between Classes Remain Constant Over Time?

Tax burdens in previous years were the direct result of policies enacted by lawmakers

at the time, reflecting the economic conditions, market structures, and voter preferences

of those periods. Today’s policies, shaped by different politicians, reflect current

economic conditions and contemporary voter preferences.

Shifts in tax burden between property classes are neither inherently positive nor

negative; they simply reflect changes in political priorities and economic realities.

Economic theory does not dictate whether changes in tax burdens over time are right

or wrong—there are always costs and benefits associated with redistributing tax burdens

between property classes.

How Is Burden Within Property Classes Estimated?

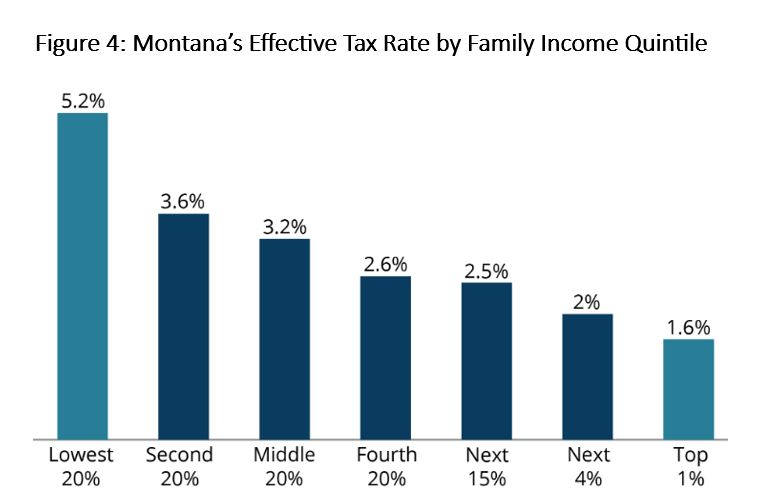

The most common measure of tax burden within property classes is the effective tax rate (ETR), calculated as:

ETR = Taxes Paid / Income

Montana’s property tax system is somewhat regressive for residential properties, meaning that families in the lowest 20% of income pay an ETR 2-3 pp higher than that of higher-income families. However, low-income assistance programs help reduce these households' tax burden.

This is Part 4 of a Series on Property Taxation in Montana.

Greg Gilpin

Professor